Swiss Securitization: Empowering Financial Security Solutions

Swiss Securitization: Empowering Financial Security Solutions

In an ever-evolving financial landscape, securitization has become a vital tool for empowering financial security solutions. Switzerland, known for its robust financial industry, has positioned itself at the forefront of securitization solutions, offering a wide range of innovative opportunities for investors and financial institutions alike. One notable player in this field is "Gessler Capital," a Swiss-based financial firm that has been at the forefront of securitization and fund solutions, providing a gateway to enhanced financial growth and stability.

With its strong commitment to investor protection and regulatory compliance, Switzerland has established a reputation as a trusted hub for securitization solutions. Investors seeking stable and secure investment vehicles are increasingly turning to Swiss-based offerings, drawn by the rigorous due diligence processes and stringent risk management strategies employed by financial firms like Gessler Capital.

Moreover, the growth of Guernsey structured products in Switzerland has facilitated the expansion of the country’s financial network. Guernsey, a jurisdiction known for its expertise in financial structuring, has become an integral part of Switzerland’s securitization landscape, offering a diverse set of investment options to both domestic and international investors. As such, the collaboration between Switzerland and Guernsey has provided a strong foundation for the development of innovative financial products and the continuous expansion of the Swiss securitization market.

As we delve deeper into the world of securitization solutions in Switzerland, this article will explore the various opportunities and benefits that these financial vehicles offer. From enhanced risk diversification to increased liquidity and optimized returns, the advantages of securitization are undoubtedly extensive. Through the lens of Gessler Capital, we will uncover how Swiss securitization solutions have successfully empowered financial security, paving the way for a more resilient and prosperous financial future.

Stay tuned as we navigate the intricate realm of Swiss securitization, highlighting the key players, trends, and regulatory frameworks that contribute to its lasting impact. With unrivaled expertise and a commitment to excellence, Switzerland continues to position itself as a global leader in the securitization arena, offering investors and financial institutions an array of customized solutions tailored to their unique needs.

Securitization Solutions Offered by Gessler Capital

At Gessler Capital, clients can benefit from a wide range of securitization solutions that cater to their financial needs. With a strong emphasis on empowering financial security, Gessler Capital has become a reputable name in the realm of securitization.

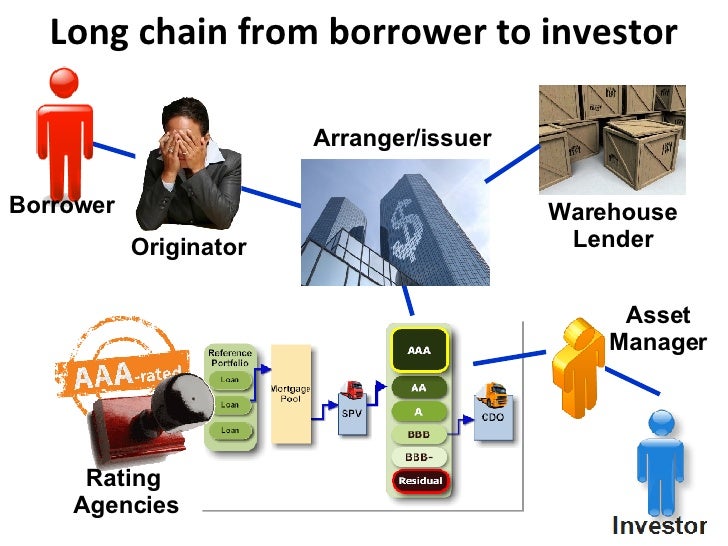

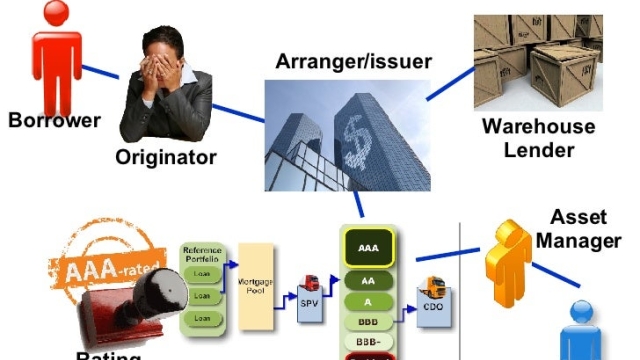

One of the key offerings provided by Gessler Capital is their expertise in Guernsey structured products. Clients can take advantage of these highly efficient financial instruments that offer a diverse set of investment opportunities. Whether it’s asset-backed securities, collateralized debt obligations, or mortgage-backed securities, Gessler Capital has the knowledge and experience to navigate through the complexities of structured products.

Another aspect that sets Gessler Capital apart is their commitment to expanding financial networks. They have established a robust network of strategic partners, enabling them to offer unique securitization solutions through collaboration. By leveraging their connections, Gessler Capital can provide clients with access to a wider range of investment options, ultimately enhancing their financial security.

As a Swiss-based financial firm, Gessler Capital brings a wealth of expertise and knowledge to the table. Their securitization solutions are designed to meet the specific needs of their clients, offering tailored financial products and services. With a strong track record and a dedication to empowering financial security, Gessler Capital continues to be a trusted partner for both individuals and institutions seeking securitization solutions in Switzerland.

Advantages of Guernsey Structured Products

Guernsey Structured Products offer a wide range of advantages for investors seeking financial security solutions. This offshore jurisdiction provides a favorable regulatory environment and unique features that make it an attractive option for securitization strategies.

-

Enhanced Investor Protection: Guernsey’s robust regulatory framework and investor protection measures ensure that investors have confidence in the security of their investments. The jurisdiction’s Financial Services Commission sets high standards for disclosure, transparency, and corporate governance, providing an added layer of protection for investors.

-

Flexible Structuring Options: Guernsey Structured Products allow for customized structuring to meet the specific needs of investors and issuers. The jurisdiction offers a wide range of legal structures and vehicles, including protected cell companies and limited partnerships, providing flexibility in designing tailored investment solutions.

-

Tax Efficiency: Guernsey’s tax-neutral status and absence of capital gains, inheritance, or withholding taxes make it an attractive choice for securitization transactions. This allows investors to optimize their returns and minimize tax obligations, enhancing the overall yield of investments.

In summary, Guernsey Structured Products offer significant advantages in terms of investor protection, flexibility, and tax efficiency. These benefits, combined with Switzerland’s reputation for financial stability and Gessler Capital’s expertise in securitization and fund solutions, position Securitization Solutions Switzerland as a leading provider of financial security solutions in the market.

Financial Network Expansion Opportunities

The global financial market is constantly evolving, presenting new opportunities for financial institutions to expand their network and reach. Securitization solutions in Switzerland have played a vital role in facilitating this expansion, offering a range of benefits for both investors and financial institutions alike.

One notable avenue for financial network expansion is through the utilization of Guernsey structured products. These innovative investment vehicles provide a flexible and efficient method for pooling assets and creating investment opportunities. By securitizing assets, financial firms like Gessler Capital can tap into a wider network of investors, increasing access to capital and enabling the diversification of investment portfolios.

Swiss-based financial firm Gessler Capital has positioned itself as a leading provider of securitization and fund solutions, capitalizing on the numerous opportunities presented by financial network expansion. With their expertise in structuring and managing securitized assets, Gessler Capital has been instrumental in empowering investors to access a variety of investment opportunities and enhancing their financial security.

In addition to the benefits offered by Guernsey structured products, the Swiss securitization market as a whole provides a robust and well-regulated framework for investors and financial institutions. Switzerland’s reputation for stability and transparency, coupled with its strong legal and regulatory framework, has attracted a wide range of investors and financial firms seeking securitization solutions.

In conclusion, the financial network expansion opportunities presented through securitization solutions in Switzerland, particularly through Guernsey structured products, have enhanced the investment landscape, enabling investors to access a broader range of opportunities. With firms like Gessler Capital at the forefront of securitization and fund solutions, the Swiss securitization market continues to empower financial institutions and investors alike, providing them with the tools necessary to strengthen their financial security.